Are you a skilled crypto trader held back by a lack of capital? You are not alone. Most retail traders struggle not because they lack strategy, but because they lack the buying power to make significant profits. This is where proprietary trading firms come in. In this comprehensive Funding Pips review, we will analyze why this specific firm has become a beacon of hope for beginners and experienced traders alike in the volatile world of 2025.

Prop firms have revolutionized the financial sector, allowing individuals to trade with up to $100,000 or more of the company’s capital. However, finding a legitimate, low-cost, and reliable firm is difficult. Visit Our Homepage for more prop firm insights. Funding Pips stands out by offering a streamlined evaluation process, competitive spreads, and a trader-friendly environment. Whether you are looking for a Funding Pips discount code or just want to understand their payout structure, this guide covers it all.

What is Funding Pips?

Funding Pips is a proprietary trading firm designed to scout and fund talented traders. Unlike traditional brokers where you risk your own money, a funding pips prop firm account allows you to manage the company’s capital after passing an evaluation. They operate on a simple premise: you bring the skill, they bring the money, and you split the profits.

Note for Beginners: For a Crypto Newbie, this model is ideal. It mitigates personal financial risk. If you lose the funded account (by hitting a maximum loss limit), you do not owe the firm the lost capital; you simply lose the account fee.

Is Funding Pips Legit?

In the unregulated specific niche of prop trading, trust is paramount. Funding Pips has established a reputation for timely payouts and transparent rules. According to recent industry data, over 70% of prop firm complaints relate to hidden rules or refused withdrawals. Funding Pips combats this with a transparent FAQ and automated payout systems.

“Reliability in the prop trading space is defined by the speed of payouts and the clarity of the drawdown rules.” – [Citation: Financial Markets Report, The Prop Trading Landscape, 2024]

The Evaluation Process: How to Get Funded

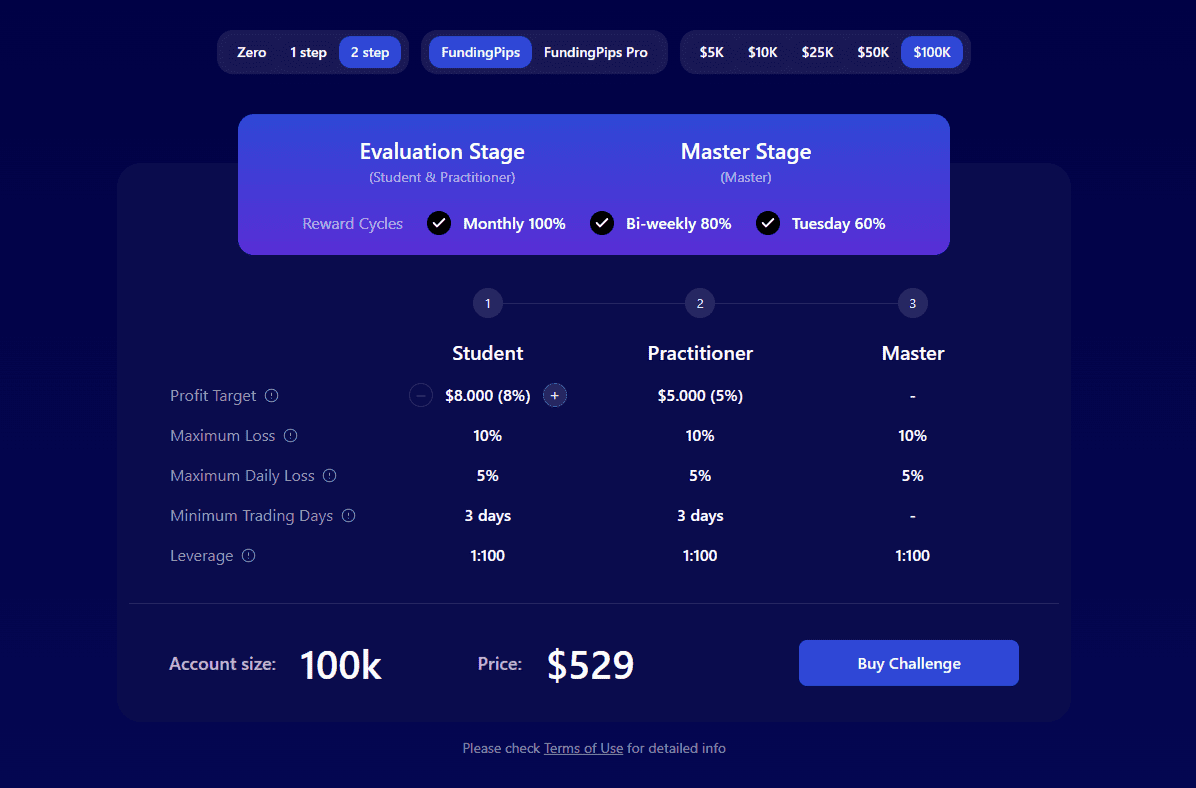

To access the capital, you must prove your discipline. The Funding Pips evaluation is divided into two phases before you reach the “Master” (Funded) stage.

This is the initial challenge. You must reach a specific profit target while adhering to strict risk management rules.

- Profit Target: Typically 8%

- Daily Loss Limit: 5%

- Max Overall Loss: 10%

- Time Limit: Infinite

Once you pass Phase 1, you move to the verification stage. The rules are slightly relaxed to test your consistency.

- Profit Target: Reduced to 5%

- Daily Loss Limit: 5%

- Risk Rules: Same adherence

Congratulations! You are now a funded trader. There are no profit targets here. You trade, you generate profit, and you request withdrawals.

Funding Pips vs. Competitors

How does Funding Pips stack up against other major prop firms in 2025? Here is a quick comparison.

| Feature | Funding Pips | Industry Average |

|---|---|---|

| Profit Split | Up to 90% (with scaling) | 80% |

| Time Limit | Unlimited | Often 30-60 Days |

| Payout Cycle | Every 5 Days | 14 – 30 Days |

| Crypto Spreads | Raw / Competitive | Often High |

Key Features for Crypto Traders

Why should a crypto enthusiast choose fundingpips over competitors?

1. Crypto-Friendly Conditions

Many prop firms treat crypto as a second-class asset with massive spreads. Funding Pips offers raw spreads on major pairs like BTCUSD and ETHUSD. Furthermore, they allow weekend holding for crypto assets, which is crucial since the crypto market never sleeps.

2. High Leverage

Leverage allows you to control larger positions with a smaller margin. Funding Pips provides competitive leverage, typically up to 1:100 for Forex and adequate leverage for Crypto, balancing buying power with risk management.

3. Fast Payouts

Cash flow is king. Funding Pips is known for its 5-day payout cycle, which is significantly faster than the industry standard of 14 or 30 days.

Pricing and Funding Pips Discount Code

Cost is a major factor for beginners. Funding Pips offers one of the most affordable entry points in the market. Account sizes range from $5,000 to $100,000.

While prices are subject to change, a $5,000 account typically starts around $32, making it accessible for almost anyone. Traders frequently search for a funding pips coupon code or a funding pips discount code. These codes are often released during holidays or special events.

Pro Tip: To check for the latest active discounts, you can visit the sign-up page directly. If you are looking for a detailed comparison of their pricing versus other firms, check out this analysis on Funding Pips features and pricing.

Trading Platforms and User Experience

The funding pips sign in process is straightforward. Once registered, you gain access to a dashboard that tracks your trading metrics in real-time. This is vital for managing your Daily Loss Limit.

Funding Pips generally supports platforms like MetaTrader 5 (MT5) or Match-Trader (depending on current partnerships and regulatory updates). These platforms are industry standards, supporting Expert Advisors (EAs) and custom indicators, which is great for algorithmic crypto traders.

Pros and Cons

To provide an honest funding pips review, we must look at both sides of the coin.

Pros

- No Time Limits: Take as long as you need to pass the evaluation.

- Low Cost: Very affordable evaluation fees.

- Crypto Trading: Favorable conditions for digital assets.

- Scaling Plan: Potential to increase your account size and profit split up to 90%.

Cons

- Daily Drawdown: The strict daily loss limit can catch aggressive traders off guard.

- Platform Volatility: Like many prop firms, platform availability can change based on software licensing.

Strategic Tips for Passing the Challenge

Passing the evaluation isn’t just about luck; it requires strategy. Here are tips tailored for the Funding Pips environment:

- Risk Management First: Never risk more than 1% of your account on a single trade. With a 5% daily limit, risking 2% only gives you two strikes before you fail.

- Understand the Daily Loss: It is often calculated based on equity. If you have floating profit that turns into a loss, it counts toward your daily limit.

- Stick to Your Niche: If you are a crypto newbie, stick to Bitcoin or Ethereum. Do not try to trade exotic Forex pairs you do not understand just because the spread looks low.

For a broader perspective on how proprietary trading fits into the global financial ecosystem, you can read reports from Bloomberg Markets or educational resources from Investopedia’s Prop Trading Guide.

Frequently Asked Questions

Does Funding Pips accept US traders?

Regulations change frequently. Currently, Funding Pips operates globally, but it is essential to check their specific Terms and Conditions regarding US clients as policies for US-based traders in the prop firm industry are volatile.

How do withdrawals work?

Withdrawals are processed via cryptocurrency (USDT) or Rise. Payouts are eligible every 5 days once you are a funded trader and have generated profit.

Is HFT (High Frequency Trading) allowed?

Funding Pips generally restricts HFT and arbitrage strategies that exploit platform latency. Stick to manual trading or standard EAs to avoid account termination.

Conclusion

In conclusion, this Funding Pips review highlights that the firm is a top-tier choice for modern traders, especially those interested in cryptocurrency. With its low barrier to entry, transparent rules, and high profit splits, it offers a legitimate pathway to professional trading capital.

Whether you are looking to escape the limitations of a small personal account or simply want to diversify your trading portfolio, Funding Pips provides the infrastructure you need. Remember, the market rewards patience and discipline.

Ready to start your journey? Don’t wait for the market to move without you.

For more insights, return to our [INTERNAL LINK: Funding Pips Review – https://funding-pips.dev/funding-pips-review] or check out the latest updates on our homepage.

🚀 Ready to Get Funded?

Start your evaluation today and join thousands of funded traders.

Start Your Funding Pips Challenge Today